Crypto Predictions: Local Lockdown Periods and Challenges to OpportunitiesIntroduction

The cryptocurrency market is known for its utter volatility, which entails price movements within hours. Market trends are of paramount importance for traders and investors to timely implement decisions in realizing profits. Today in crypto predictions, the mindset and direction of short-term price movements can help market participants anticipate possible changes, seize trading opportunities, and manage risks. These predictions provide orientation in the fast track of digital asset evolution by merging technical issues, culture, and information trends, along with recent news.

Understanding Crypto Predictions Today

Crypto predictions today have been debated over whether the price is to move higher or lower within 24 hours. Unlike long-term forecasts that consider adoption trends, paradigms in law, and ecosystem building, short-term predictions deal with factors such as trading volumes, momentum indicators, or recent news. Such information becomes especially pertinent to day traders or short-term investors who rely on current insight to make profitable trades. By comparing real-time and past data, traders are able to determine possible highs, lows, and reversals in prices over the course of a single trading day.

Key Factors That Affect Crypto Predictions Today

Although there are many, a few extremely influential factors concern today’s crypto predictions:

Market Sentiment: Price can be driven to sharp movements within a day owing to public perception, social media activities, and investors’ feelings.

News and Events: Announcements about regulations, partnerships, or network upgrades can instantly impact cryptocurrency prices.

Technical Indicators: These include moving averages, Relative Strength Index (RSI), Bollinger Bands, and MACD to spot trends, reversals, and momentum.

Trading Volume and Liquidity: When trading volume is high, price trends tend to be smoother, whereas illiquidity can cause sudden price jumps.

External Economic Factors: Macroeconomic news, geopolitical events, and overall market sentiments in traditional finance can impact the movements of cryptocurrencies.

Tools and Techniques for Daily Predictions

To derive reliable crypto predictions, traders presently use the following analysis techniques:

Candlestick Analysis: Traders analyze hourly or daily candlestick patterns for signals of reversals or trends of continuation.

Moving Averages: They use simple moving averages and exponential moving averages for short-term market direction.

RSI and MACD: These momentum indicators point out the overbought or oversold levels in the market and thereby assist in predicting the trend phase into which it is going to evolve.

Support and Resistance: Recognizing the critical price point enables a trader to anticipate a potential breakout or a pullback.

Volume Interpretation: It serves the purpose of verifying trends and evaluating strength.

Most Popular Cryptos in Daily Predictions

Short-term price predictions are usually attempted on top cryptocurrencies with respect to their liquidity, market influence, and adoption:

Bitcoin (BTC): Being the biggest cryptocurrency by market capitalization, the movement of BTC hugely affects the wider market trend.

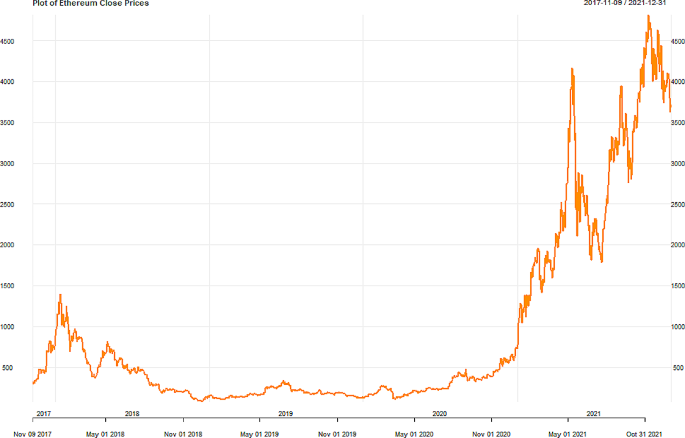

Ethereum (ETH): Smart contract activity, adoption of decentralized finance, and network upgrades affect the price of ETH.

Ripple (XRP): Regulatory backdrop, new partnerships, and general market sentiment can fast-trigger short-term price changes.

Binance Coin (BNB): Usually, actions inside Binance affect BNB price movements on a daily scale.

Cardano (ADA) and Solana (SOL): Short-term performances depend on network upgrading, staking activities, and changes happening within the ecosystem.

Realibon Purpose For Expert Predictions Today

Today, expert platforms lend crucial support to traders and investors in their crypto predictions. Zephyr stands out among the few platforms that provide real-time analytics, predictive models, and expert commentaries. By using a mix of past data, sentiment, and market indicators, Zephyr builds actionable intelligence capable of predicting short-term price movements. The platform uses algorithmic forecasting methods alongside analyses by build experts to guide trading decisions for investors, thereby reducing uncertainties in a volatile market.

Pros of Using a Platform Like Zephyr

Sites like Zephyr lend support to making current crypto predictions more reliable:

Real-Time Data: Zephyr provides real-time market data for short-term trading decisions.

Expert Insights: Price movements are brought into perspective by commentary from professional commentators, with emerging trends being highlighted.

Action Age Forecasts: The predictions help traders decide where to enter and where to exit, given the present conditions.

Risk Management: Alerts and insights allow investors to implement strategies that minimize potential losses.

Strategic Development: These precise daily predictions permit more informed decisions on trading and portfolio adjustments.

How to Implement Daily Predictions

Cryptocurrency traders have several strategies at their disposal.

Day Trading: Intraday price fluctuations can be used to make multiple trades based on these predictions.

Swing Trading: Short periods of holding, about predicted daily price movements.

Stop-Loss and Take-Profit Orders: Placing protection on and taking profit against predicted price levels.

Portfolio Diversification: Allocating investments between multiple types of cryptocurrencies to reduce one’s risk exposure.

Automated Alerts and Trading Bots: Technology-based systems allow for sufficient time to act promptly on anticipated price movements.

Constraints on Short-Term Crypto Predictions

Some competing factors exist for good predictions, discussed below:

Extreme Volatility: Price surges and sudden drops that occur in rapid succession affect the prediction’s accuracy.

Externalities: Regulatory announcements pop up, macroeconomic developments take place, and technological issues occur—prices do not react predictably to these very factors.

Speculative: They are based on analyses and assumptions and can never guarantee precisely what happens.

Overreliance: They should never be; they do provide considerable guidance, but one needs experience and good judgment to interpret market dynamics effectively.

Conclusion

Crypto predictions today are essential for traders and investors working in the fast-paced and volatile markets of cryptocurrency. The basis for making such predictions rests on using technical analysis, past trends, sentiment analysis, and expert opinion so participants may enter into informed trades, manage their risks, or simply take advantage of an opportunity. Analytic giants like Zephyr support actionable strategies for short-term trades by providing real-time trends, predictive modeling, and analyses from industry professionals. Hence, an investor works with the best daily predictive value to forecast the price, time his/her trades, and thereby maintain a competitive edge in a constantly evolving crypto world.