A Beginner’s Guide on How to Sell Pi

For many who have been mining Pi through their mobile devices, the transition from accumulating coins to converting them into tangible assets is an important step. As the network moves towards greater openness, understanding the correct and safe procedure for selling is crucial. This guide provides a clear, step-by-step process for new users, covering everything from initial preparation to the final withdrawal of funds.

The Current Status of Pi Trading

Before attempting to sell, it is vital to understand the network’s current operational phase. This knowledge helps manage expectations and avoid potential pitfalls common in the evolving digital currency landscape.

Understanding the “Enclosed Mainnet”

The Pi Network currently operates in what is known as an “enclosed mainnet” phase. This means that while the blockchain is live, it is protected by a firewall that prevents unrestricted external connectivity. As a result, Pi cannot be freely traded on most major exchanges yet.

Full trading capabilities on a wider range of platforms will become available only when the network transitions to its “open mainnet” phase. Until then, transactions are primarily limited to within the Pi ecosystem and on a select number of supported platforms.

Avoiding Common Scams

The anticipation surrounding Pi has unfortunately attracted fraudulent schemes. New users should be highly cautious of platforms or individuals promising instant sales or unusually high returns. Common red flags to watch for include:

- Websites or apps asking for your wallet’s private keys or seed phrase.

- Peer-to-peer (P2P) offers in social media groups that lack escrow protection.

- Services claiming to connect your wallet to “pre-listed” markets before an official launch.

Always verify information through official Pi Network channels and never share your credentials.

Essential Preparations Before You Sell

Proper preparation is the key to a secure and successful transaction. Before you can sell your Pi, several mandatory steps must be completed to ensure your account is verified and your assets are ready for transfer.

Complete Your KYC Verification

Know Your Customer (KYC) verification is a mandatory requirement. This process is essential for complying with global financial regulations and preventing fraudulent activities. You can complete KYC through the Pi Browser app by submitting a valid government-issued ID and passing a facial recognition check. Without KYC approval, you cannot transfer your coins.

Migrate Your Tokens to the Mainnet

Once your KYC is approved, you must migrate your mined Pi from the app to the mainnet. This action moves your balance onto the actual blockchain, making your coins real, transferable assets. Coins that are still in the app or on the testnet cannot be sold. This migration is a critical step to confirm your ownership on the blockchain.

Set Up a Secure Wallet

A secure, compatible wallet is necessary to hold your mainnet Pi. While the official Pi Wallet is the standard option, other wallets may also offer support. The most important aspect is that you control your private keys and seed phrase. Write down your seed phrase and store it safely offline; losing it means losing access to your funds forever.

A Step-by-Step Guide to Selling Pi

After completing all preparatory steps, you can proceed with selling your tokens. The process involves moving your Pi to a supported exchange and executing a trade.

Step 1: Choose a Supported Exchange

Because the network is not yet fully open, Pi is only listed on a select number of centralized exchanges. Platforms such as Bitget, OKX, Gate.io, and MEXC have been noted to support Pi trading. Before creating an account, verify that the exchange supports mainnet Pi deposits, not just IOUs or placeholder tokens. Also, check for regional restrictions.

Step 2: Transfer Pi to the Exchange

Log in to your chosen exchange and find the deposit section. Select Pi to generate a unique deposit address. In your personal Pi wallet, initiate a transfer by pasting this address.

It is highly recommended to send a small test amount first. Once you confirm the test transaction was successful, you can transfer the remaining balance. Always ensure you are using the correct “Pi Mainnet” network for the transfer.

Step 3: Place Your Sell Order

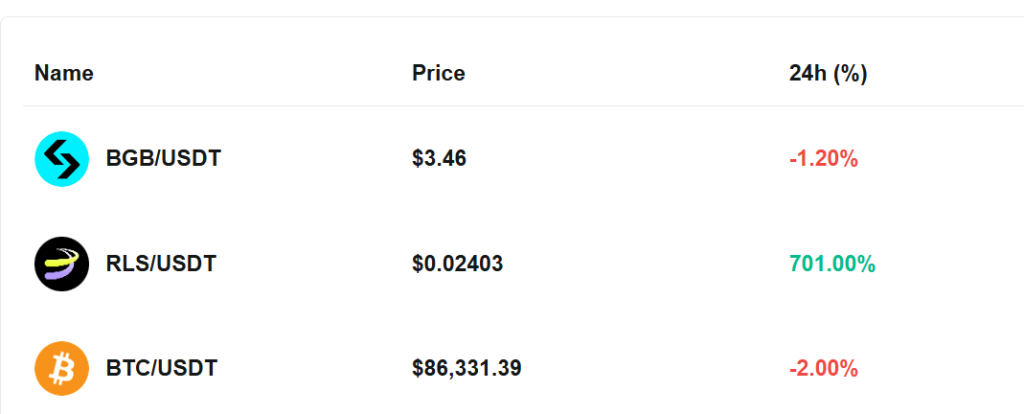

Once the funds arrive in your exchange account, navigate to the spot trading section and find the PI/USDT or another available trading pair. You have two main options for selling:

- Market Order: Sells your Pi immediately at the current best available price.

- Limit Order: Allows you to set a specific price at which you want to sell. The order will only execute when the market reaches your target price.

Understanding these order types is a crucial part of learning how to sell pi coin. Enter the amount you wish to sell and confirm the order.

Step 4: Withdraw Your Funds

After the sale is complete, the proceeds (usually in a stablecoin like USDT) will appear in your exchange wallet. You can then withdraw these funds. Options typically include transferring them to a bank account via fiat off-ramps or moving them to a personal crypto wallet.

Alternative Methods and Key Considerations

While using a centralized exchange is the most common method, it is important to be aware of other options and associated factors.

Peer-to-Peer (P2P) Trading

Some users attempt to sell Pi directly to other individuals through P2P transactions. This method is extremely risky as it often lacks an escrow service to protect the seller. The potential for fraud is high, and transactions are irreversible if the buyer fails to send payment. It is generally best to avoid this method.

Understanding Fees and Taxes

Selling digital assets involves costs. Be prepared for several types of fees, including trading fees charged by the exchange, withdrawal fees for moving your funds out, and network fees for blockchain transactions.

Furthermore, profits from selling crypto are typically considered taxable events in most countries. It is your responsibility to keep records of your transactions and consult with a local tax professional to ensure compliance.